Coaching is beneficial to any insurance agent, no matter their experience level. Whether you are new to the industry or are looking to grow your business, I’m sure that insurance agent coaching will change your life.

With my unique insurance coaching program, together we will dive into different ways to improve your business. From maximizing your income to helping you navigate through tough times, here are all the ways my insurance coaching will improve your life.

1. Learn How to Improve Your Business

Through a business and personal analysis, we will uncover different areas with opportunities for improvement. This process will break down areas of your business, but you will also need to take a look at yourself and your habits.

Are you motivated? Are you willing to do what it takes to reach your goals? Let’s find out together.

People often fail in this industry because they can’t get a handle on their money management. Looking at your areas for improvement will better your life and your business.

Investing in Yourself Is Critical

Many agents fail to treat their business like a business. What does this mean? It means that they want the lavish lifestyle that accompanies income but do not want to spend their money to get there.

You’ve heard it said, and it’s not a cliché: you need to spend money to make money. You need to invest in yourself so that you continue to grow and improve. With my insurance coaching, you will be taking the first step you need to start investing in your success. You will finally be able to purchase that car you have always envisioned for yourself, but you won’t get there until you understand that you have to give to take.

More Ways to Improve Your Business

Improving your business is not only about money management. Together, we will look into all the aspects of your business, including:

- Leads

- Closing

- Cold calls

- Contracts

- Products

- Recruiting

- Referrals

- Retention

By doing so, we will help your business to flourish.

2. Understand How to Navigate Tough Times

You put money in each week in the hope of returns, but they do not always work out. As a result, you may start to feel discouraged and even consider giving up. How do you avoid this feeling, though? Once you learn how to navigate through a slow period, nothing will be able to slow you down or steal your momentum!

You cannot always avoid hard weeks. They happen to the best of us. However, you can prepare for them by using my lead strategy and sales process, so you always have a plan, and always know what to focus on.

People who plan for the unexpected are more likely to succeed than those who don’t. Together, we can ensure you keep thriving.

3. Optimize Your Referrals

As an insurance coach, I can help you understand the importance of referrals and how to use them. After all, referrals are your organic growth.

Even if you get just one referral from a lead, that essentially cuts down your lead cost because you get two opportunities for the price of one. But I don’t want you to get just one referral from each person you talk to; I want you to get a MINIMUM of 3. The more referrals you get from each lead, the better.

You might be thinking, “Pete, I already ask for referrals, I know they are important”. To that I ask, are you getting 44+ referrals per week? Learning to work your referrals strategically will elevate your business like you would not believe. I would love to show you how to do it.

How Will Referrals Change Your Life?

So, we have determined referrals are essential, but how are they going to change your life?

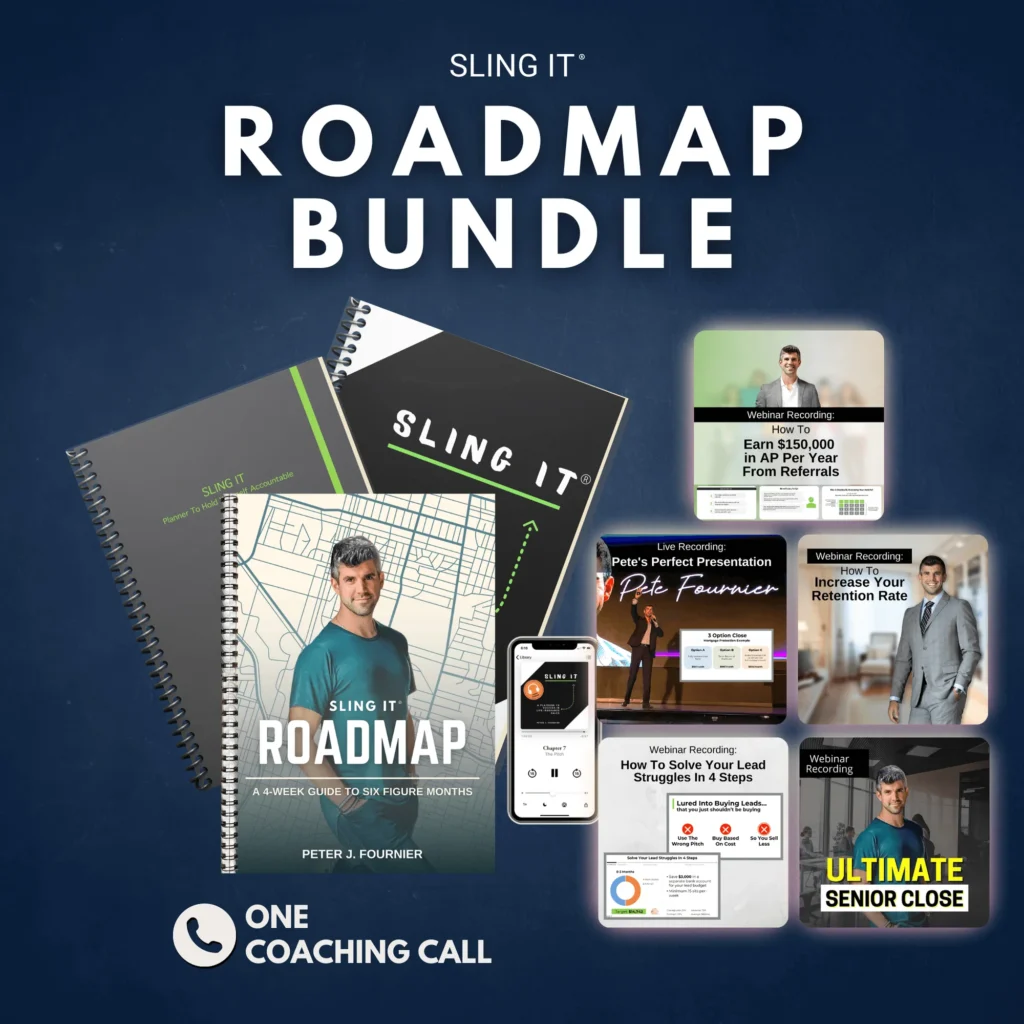

Simple. Maximizing your referrals drastically increases your activity. Let’s do easy math, if you have 20 sits and six sales in one week, that means you have 14 no’s If you get one referral from each no, that’s 14 new prospects that you can go after. From the six sales, you should receive 30 referrals if you follow my referral process. That’s 44 referrals a week! That’s 2,112 a year (if you take a month off). If you stink and close 10% of those referrals, that’s another 211 apps a year. In the worst-case, you just earned an additional $145,000 – 150,000 a year in annual premium.

4. How to Best Work Your Leads

Working leads is what being an insurance agent is all about. Together, we will take a deep dive into the world of leads and understand how to get the most out of them.

When you first start, if you are anything like me, you may be working off aged leads, and that’s okay. I LOVE working aged leads! So many agents underestimate them and don’t understand how valuable they can be.

Winning With Aged Leads

My training, How To Solve Your Lead Struggles In 4 Steps’ is a game-changer! I can show you how to refresh three-year-old leads and turn them into sales. This will help you save money if you can’t afford those new leads just yet. I have an entire lead strategy that will solve all of your lead struggles. Check it out here.

Working Your Warm Market

A significant point we will cover during our coaching call is how to work your warm market. Warm market sales can be the best thing for you. It is your duty to make sure your friends and family are protected. Are you going to leave that job up to a stranger? I hope not.

Most agents get nervous “talking shop” with their friends and family. I can help you overcome those (oh so common) fears and worries. Together, we will come up with the best possible way for you to work your warm market so that you get the most out of it.

5. Understanding Phoning

What is the best method of phoning clients? Whether it is cold calls or merely talking on the phone with a client, there is a barrier to overcome.

They can’t see your hand movements or a friendly smile. You have to build trust through the words you use and how you sound.

Confidence is key. Together we can go through different phoning techniques to help you succeed.

6. The Importance of Retention

Something you will hear me preach about time and time again is how retention is pivotal to your business. Why is that true, though?

Well, let’s think about it. How much money would you make if your client retention-rate were 90 percent instead of the average of 70 percent?

How Do You Increase Your Persistency?

If you add two to five more minutes to your script, you can change your persistency from 70 percent to 90 percent in no time. Wouldn’t it be great to have your clients keep coming back to you rather than having to waste money on new leads all the time?

I have spent so much time trying different scripts and strategies to retain more of my own clients. Now that I’ve perfected what works, I want to share the answers with you. Through my insurance coaching, we can talk about my different tips and tricks to make this happen for you.

7. Help You Optimize Your Social Media Presence

In order to get new clients, they need to be able to find you easily. This is something many agents don’t take into consideration.

It is perfectly okay for you to promote yourself on social media platforms. In fact, it is better because people can start to get to know you before you even meet.

People who scroll through your social media profiles are more likely to trust you. This trust means they are more willing to become your client.

I can help give you different social media tips to help you land those clients.

Why Does Social Media Matter?

People are continually going to social media to research and make purchases, including insurance.

You’ll be surprised to learn how many clients reach out to me on Facebook and Instagram.

You can get new clients through these platforms too! Together, we can go through different social media techniques to help you attract more potential clients. Make social media work for you.

8. Learn How to Set and Reach Your Goals

We all have dreams of living our ideal lifestyle. How do you get there, though?

Together we can set goals for your life and your business. Then we will go through what you can do to meet them. Once you meet those goals, it is time to set new ones!

Goal setting sounds relatively easy, but most people struggle to set the right goals and don’t create a plan to achieve them. There is nothing worse than setting an unattainable goal that leaves you feeling hopeless because you never even get close. I can help you map out what goals you should focus on and the action plan you need to achieve them.

9. Maximize Your Income

I am all about helping you make the most money possible. Through coaching, we will go into great detail about the sales process.

Each step is imperative to your success, so it helps to understand the importance of each. We will dive into how to make contact, nurture the prospect, and close that sale with the maximum income possible.

Learn How to Increase Your Deals

As an experienced insurance agent who still goes out into the field, I can help you make the most money from each lead, sit, and dial.

For example, if the client qualifies, you should always back up any IUL sales and whole-life sales with a small-term policy. This will not only benefit you by adding about $1,000 per sale but also helps your client.

I have many simple tips to maximize your income and make your clients happier and more secure. Happier clients mean more referrals and contacts.

Insurance Agent Coaching Is A Necessity

No matter where you are in your business, there is always room to grow. I can help facilitate this growth through one-on-one coaching.

Not only will this coaching change the course of your business, but it will also change how you live your life—no more hoping for that breakthrough. I can help you get started today!